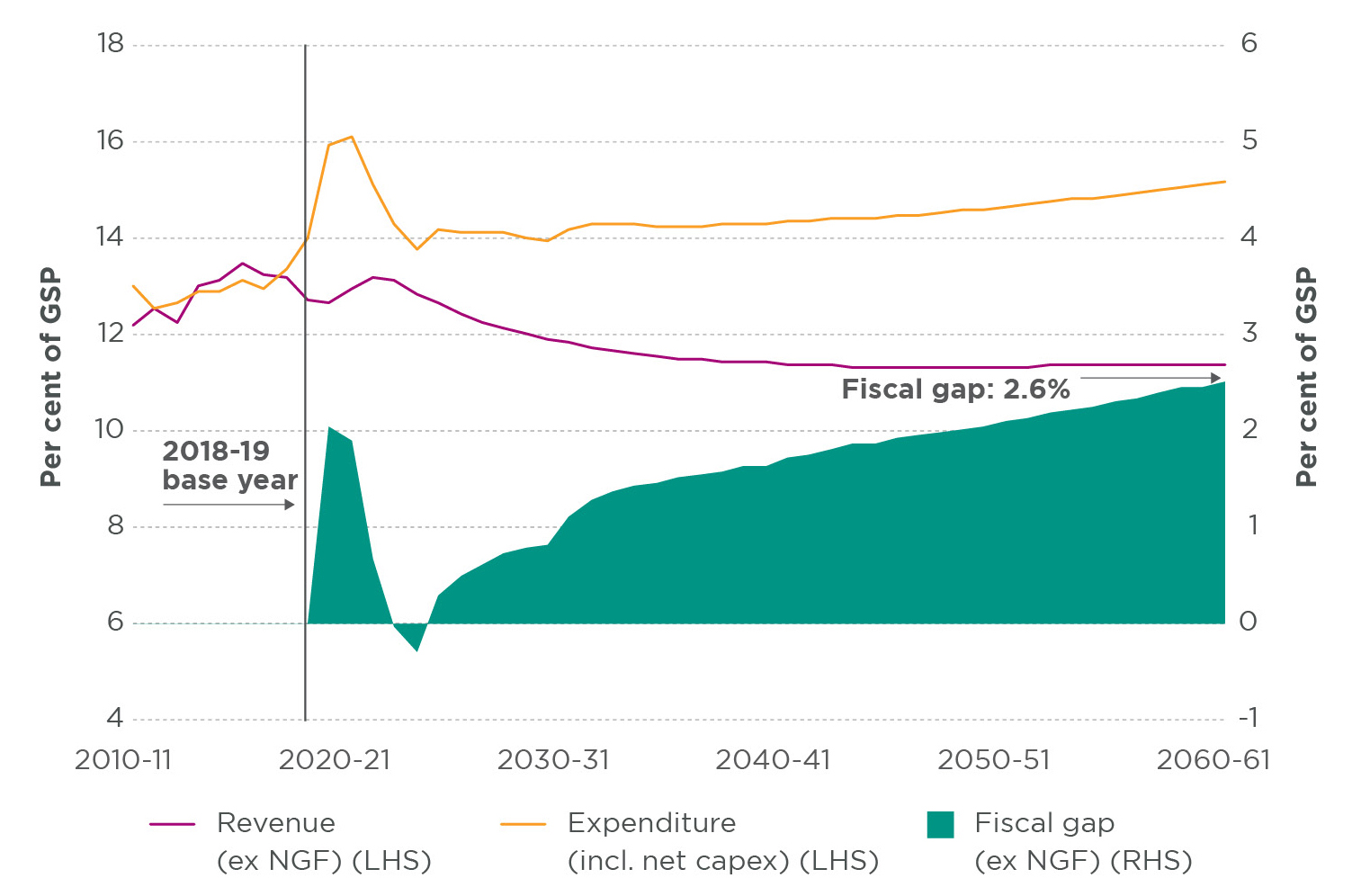

Without action to address the structural imbalance between revenue and expense growth, the State’s long-term fiscal position will deteriorate. By 2060-61, we project the fiscal gap to reach 2.6 per cent of Gross State Product (GSP).

This gap means that governments will be increasingly reliant on borrowing to fund the delivery of services and infrastructure, with net debt projected to reach 100 per cent of GSP by 2060-61. The NSW Generations Fund, however, will provide a substantial pool of assets that future generations can use to help manage any build up in debt.

There are a range of policy opportunities open to government to lift economic growth and address the fiscal challenge. Measures include boosting workforce participation and productivity, continued improvements in our health and education systems, modernising the State’s revenue base, and reforms to GST and Commonwealth-State funding arrangements.