On this page

Overview

This section provides an overview of the key legislation and frameworks that underpin budget management and governance in New South Wales.

It seeks to support senior decision-makers to better understand these obligations and their application to the operation of agency budgets and functions.

An understanding of these obligations and requirements is crucial to operationalising the six principles - as outlined in the Introduction – to support the government’s commitment to responsible budgeting and financial management.

Budget governance

Key points

- The State’s fiscal strategy sets the direction for the budget process and guides the allocation of resources.

- A legal authority via an appropriation is required to spend public funds from the Consolidated Fund.

- In addition to the appropriation limit, agency budgets are managed and tracked by three budget controls – Net Cost of Services, Labour Expense Cap, and Capital Expenditure Authorisation Limit.

- The annual budget process is the primary means to set appropriations and adjust budget controls.

- Ministers must report to the Treasurer on any budget control breaches.

The State's fiscal strategy acts as the compass for the budget process, guiding decisions on how to allocate resources effectively. It serves three critical functions:

- setting clear priorities

- promoting transparency and accountability

- enabling informed decision-making.

| Setting clear priorities |

Includes the setting of short-term and long-term fiscal objectives for the State’s fiscal sustainability, such as operating and debt position objectives. The budget process then translates these objectives into the State’s capacity to fund service delivery and infrastructure investment over the budget and forward estimates. The budget process can then prioritise initiatives that align with the strategy. |

|---|---|

| Promoting transparency and accountability | A clear fiscal strategy allows the public and the Parliament to understand the government's financial direction and set the broad measurement by which the government is going to hold itself accountable for its investment decisions. |

| Enabling informed decision-making |

The fiscal strategy provides a framework for evaluating the financial impact of proposed policies and programs. The budget process can then focus on prioritising initiatives that deliver the most value for the allocated funds, while balancing considerations of policy effectiveness and service delivery requirements. |

Most jurisdictions in Australia articulate their fiscal strategy through several broad fiscal principles that are enshrined in legislation. The strategy informs fiscal rules or targets that the government publishes in budget papers and annual reports. It considers the State’s position in the economic cycle, and the fiscal position and outlook. Broadly speaking, the strategy encompasses fiscal policy to support the economy during economic contractions and to rebuild fiscal buffers during periods of economic growth.

In New South Wales, the government’s fiscal strategy is underpinned by legislation, including the Fiscal Responsibility Act 2012 (FRA). The FRA sets out an objective of maintaining the State’s triple-A credit rating.

The State’s fiscal position has significantly weakened since 2019-20, following the combination of high levels of recurrent spending and infrastructure investment, and revenue volatility. These impacts have left limited buffers to support the State in the event of a future shock.

It is necessary for a government to ensure its fiscal policy settings are sustainable into the foreseeable future. Fiscal stability underpins the continued delivery of essential services and investment in infrastructure for the people of New South Wales and supports the State’s economy during economic shocks and crisis.

To enable the fiscally sustainable delivery of the government’s policies and broader economic goals, the NSW Government introduced two fiscal principles in the 2023-24 Budget.

These are:

- returning to a sustainable operating position.

- stabilising and then maintaining a sustainable debt position.

In practice, these principles help guide the government’s financial decision-making, including:

- the operation of the Expenditure Review Committee (ERC)

- the annual budget process, which seeks to invest in priority areas and manage risks, while maintaining a fiscal position in-line with the FRA

- budget monitoring, including NSW Treasury policies that relate to the accuracy of, and amendments to, agency budgets.

All ministers, accountable authorities (i.e. the head of an agency or secretary) and government officers must ensure expenditure is authorised, with the appropriate legal authority and under valid delegation.

The Constitution Act 1902 (NSW) states that “all public moneys… collected, received or held by any person for or on behalf of the State shall form one Consolidated Fund” unless another Act allows for it.

To withdraw money from the Consolidated Fund, a legal authority is required through an appropriation. This is underpinned by the constitutional principle that the executive government’s expenditure of public funds must be authorised by Parliament.

In New South Wales, there are broadly three types of appropriations (outlined in Table 2 below).

| Annual appropriation | Provides ministers the authority to spend public money for the services of departments or agencies under the authority of the annual Appropriation Act. |

|---|---|

| Standing appropriation | Appropriations established under legislation other than the GSF Act or annual Appropriation Acts. They typically provide ongoing appropriations from the Consolidated Fund, for example, the Parliamentary Remuneration Act 1989. |

| Deemed appropriation | Relates to certain types of own source receipts under the GSF Act and provides a mechanism for the legally compliant expenditure of own source receipts. See Section 4.7 of the GSF Act. |

Specific Acts of Parliament may also provide for public monies to be held in other forms of statutory funds, such as a Special Deposit Account. The legal expenditure of these funds is enabled under Section 4.15 of the GSF Act.

For general government sector (GGS) agencies, the two most common legal mechanisms are the annual Appropriation Acts and deemed appropriation.

Each year, two Annual Appropriation Bills are prepared (a primary bill and a Parliament bill) and tabled alongside the Budget. The objective of these Bills is to legally authorise spending of money from the Consolidated Fund as required during the financial year for services of the government. Following approval by Parliament, the Appropriation Acts commence from 1 July and lapse after a 12-month period. The Treasurer is the responsible minister for the Appropriation Acts.

Under current practice, the appropriations are allocated to a Coordinating Minister for the purposes of departments of the public service and various Special Offices. Coordinating Ministers provide delegations and funding distributions to a group of affiliated entities. The amounts that each of these entities are allocated are determined as part of the annual budget process.

Table 3 sets out the departments and Special Offices for which ministers receive direct appropriations. The Legislature receives a separate, direct appropriation under the annual Appropriation (Parliament) Act.

| Departments | Special Offices |

|---|---|

| The Cabinet Office | Independent Commission Against Corruption |

| Department of Communities and Justice | Independent Pricing and Regulatory Tribunal |

| Department of Climate Change, Energy, the Environment and Water | Judicial Commission of New South Wales |

| Department of Customer Service | Law Enforcement Conduct Commission |

| Department of Education | New South Wales Electoral Commission |

| Department of Planning, Housing and Infrastructure | Office of the Children's Guardian |

| Ministry of Health | Office of the Director of Public Prosecutions |

| Department of Creative Industries, Tourism, Hospitality and Sport | Office of the Ombudsman |

| The Premier's Department | |

| Department of Primary Industries and Regional Development | |

| Department of Transport | |

| NSW Treasury |

Under the GSF Act, deemed appropriations provide a mechanism for the legally compliant expenditure of an agency’s own source receipts (i.e. revenue). When an agency receives an own source receipt, the lead minister for the agency (which is the Coordinating Minister) is “deemed” to have been given an appropriation:

- for an amount equal to the own source receipt, and

- for the purposes defined at section 4.7(2) GSF Act.

This deeming means that there is a formal legal authority for the receiving agency to spend the own source receipts. Financial delegations must be put in place to authorise spending of annual appropriations and deemed appropriation under the authority of the Coordinating Minister. Appropriations are a legal limit on the Coordinating Minister’s authority to spend and cannot be exceeded.

Where appropriate, the department may balance unspent appropriation across its affiliated entities. This could occur in such circumstances where there is a material pressure associated with an existing service, or a new spending decision has been made in-year.

In certain circumstances, the Treasurer may approve a variation to an appropriation limit. Those circumstances are:

- transfer of functions between agencies

- transfer of appropriation from the savings of another agency

- variations of annual appropriations for Commonwealth Grants

- exigencies of government, for urgent and unforeseen expenditures e.g. natural disasters (with approval of the Governor)

- allocation of special appropriations.

Parliament may also pass a Supplementary Appropriation Act authorising additional expenditure. However, practice in New South Wales is that only one appropriation Act is considered each year.

Departments, Special Offices, and any agency receiving any kind of appropriation are required to complete a summary of compliance at the end of the financial year to certify that appropriation limits were adhered to.

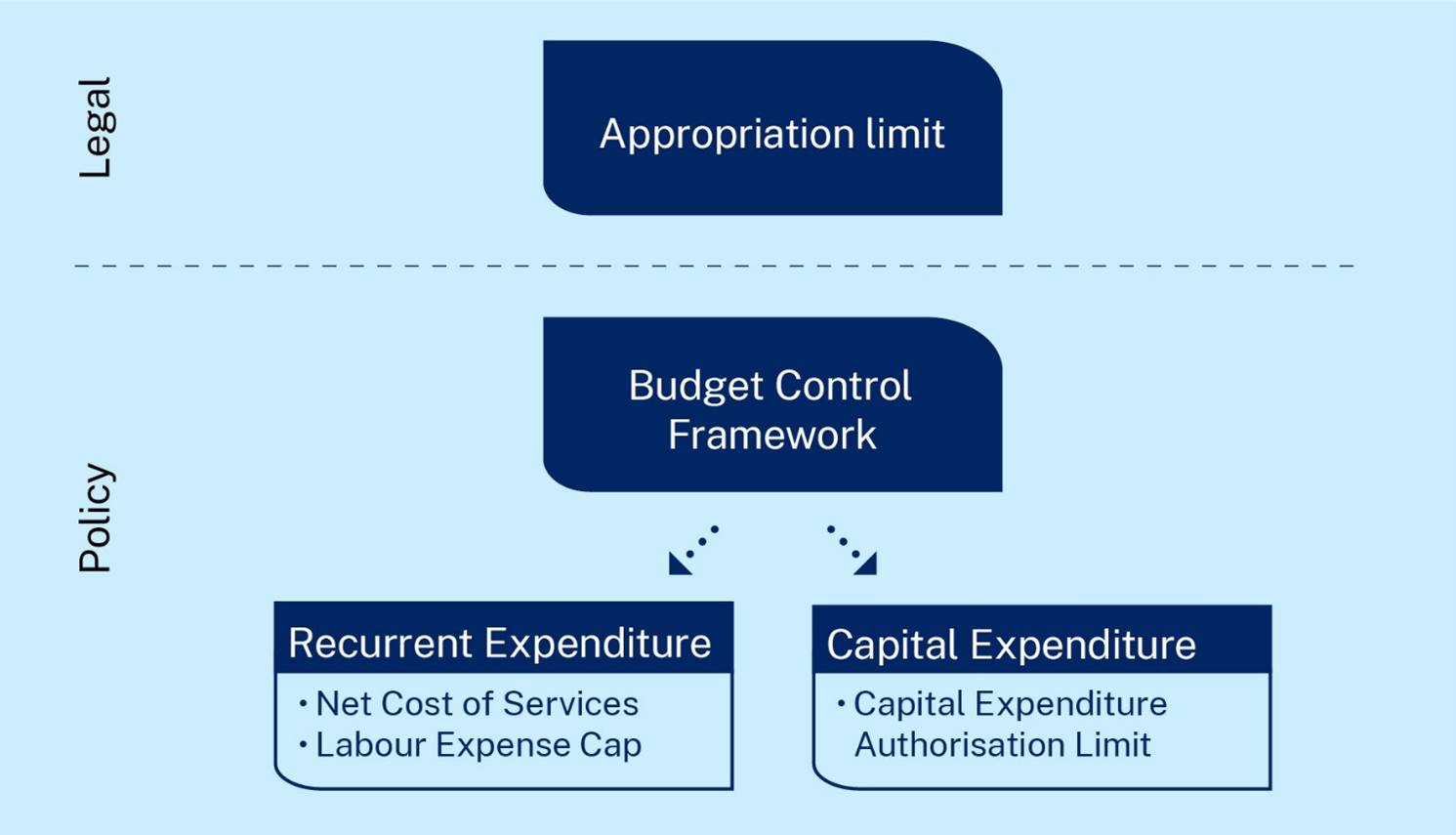

Alongside the appropriation limit, there are three budget controls that have been endorsed by government to manage and track performance of agency budgets.

These controls are a core part of the financial management framework and provide government with an effective tool to control how funds are used, including targeting specific types of expenditure. The three controls are:

- Net Cost of Services limit (NCOS): the net cost by which an agency can operate in within any year when accounting for expenses and revenues

- Labour Expense Cap (LEC): a ceiling on the total of employee related and contractor expenses that can be incurred in any year

- Capital Expenditure Authorisation Limit (CEAL): a ceiling on the total capital expenditure that can be incurred in any year.

All controls apply to the current year, forward estimates, and planning years. Budget controls do not have a tolerance level for breaches. That is, agencies are required to operate within those set limits.

The primary means for setting and adjusting budget controls is through the annual budget process. Agencies are expected to manage risks and pressures within their original budget allocations. However, where an adjustment to an agency’s budget control limit is required, this must be approved by the ERC, the Treasurer or NSW Treasury via delegation. Any request to increase control limits outside of the budget process will only be considered in exceptional circumstances.

However, to manage in-year pressures associated with existing services or programs, a minister may approve a net neutral transfer of budget controls between affiliated entities, where there is alignment with a single minister’s policy responsibility, or impacted ministers agree.

In addition to the above, a minister may also approve variances to existing capital projects of up to +/- 10 per cent of the original approved estimated total cost (ETC) and initiate new major capital work projects with an ETC of less than $5 million. The following conditions apply to that approval:

- the minister can only make such changes for capital projects to be delivered by agencies that they are responsible for

- the expenditure in each year for all capital projects can be met from within the annual capital expenditure authorisation limits for the agency

- no major project will be delayed by more than a year from the approved completion date

- all associated recurrent costs in future years can be met from within existing net cost of services limits

- NSW Treasury is consulted prior to the minister’s approval of a new major capital work project, to ensure offsetting savings are available within the capital program.

Variations to Tier 1 projects (as defined by Infrastructure NSW’s Infrastructure Investor Assurance Framework) will require approval in the budget process or from the Treasurer in exceptional circumstances.

An agency may request to move unspent budget controls from the current financial year into future financial years, in accordance with the TPG22-05: Carry Forwards Policy.

In the event that an agency breaches a budget control at the end of the financial year, the responsible minister is required to formally notify the Treasurer in writing. The correspondence must include details of the breach and actions that are being undertaken to manage risks into the future.

If the breach is material or at risk of becoming structural, additional mitigating actions may be requested. Ministers and agencies may also be required to report back to the ERC on these mitigating actions to ensure compliance with budget controls in future years.

Further information can be found in TPG24-35: Budget Control Framework.

Agencies should note that, while not a formal budget control, the NSW Government has made a commitment to reducing expenditure across a range of expense categories. Agencies are expected to implement strategies to manage expenditure within their approved budgets across these categories. This includes the following recurrent expense categories:

- Non-frontline labour hire and other contractors

- Consultants

- Travel

- Advertising

- Legal

Expenditure in these categories is closely tracked against approved budgets and 2022-23 expenditure. Any adjustments to expenditure in these categories should be supported by an explicit decision of government. Agencies are required to report on progress towards reducing expenditure under these categories, which is detailed further below in Financial monitoring and reporting.

Use of government resources

Key points

- The Government Sector Finance Act 2018 (GSF Act) establishes a principle-based framework for the use and management of public money.

- The GSF Act covers a range of activities including financial reporting, financial delegations, and financial services arrangements for agencies, and articulates roles and responsibilities across the public sector.

- The Audit Office of NSW is legislated to provide a range of audit activities, including financial and performance audits.

The management of public money is a crucial government function which aims to maximise public resources towards the greatest benefit. The GSF Act establishes a principle-based framework for the NSW public sector to guide the use and management of public money.

The GSF Act covers a range of activities relating to financial management for the public sector. This includes specific rules relating to:

- expenditure of money from the Consolidated Fund and the Special Deposits accounts

- financial and annual reporting by individual agencies, which is further outlined in Financial monitoring and reporting

- financial delegations

- financial services and arrangements, including banking, borrowing and investments

- gifting of government property

- statutory act of grace payments.

The GSF Act sets the requirement for all public sector agencies to establish effective policies for risk management, financial management and integrity of performance information. It is also critical in driving governance structures across the sector by defining roles and responsibilities.

| Role | Key responsibilities in the GSF Act |

|---|---|

| Treasurer |

The Treasurer may give written directions (Treasurer’s Directions) with respect to the principles, practices, arrangements and procedures to be applied to or followed by GSF agencies for the purpose of promoting compliance with the provisions of the GSF Act. A person or entity to whom the Treasurer’s directions apply, must comply with the provision. |

| Minister |

All ministers have responsibilities and powers in relation to financial management under the GSF Act, including:

|

| Accountable authority |

The main roles and responsibilities of an accountable authority include:

An accountable authority may perform functions, such as authorising expenditure on behalf of the State, as a delegate. |

| Government officer |

A government officer should be guided by the values and principles of the GSF Act:

A government officer may perform functions, such as authorising expenditure on behalf of the State, as a delegate. All government officers must ensure expenditure is done legally, and under valid delegation. |

Audit activities are a critical function that ensure the government is held to account for its use of public resources. Annual financial statements are audited, to provide an independent opinion as to whether the financial statements are prepared in accordance with relevant standards, laws, regulations and government directions. In New South Wales, this function is undertaken by the Auditor-General of NSW, supported by the Audit Office of NSW.

The Auditor-General and Audit Office of NSW also conduct their own program of performance and other audit engagements, which provides an opinion about the efficiency, effectiveness, economy and/or compliance of an agency or program. The Auditor-General’s forward agenda of these types of Audits is available on the Audit Office of NSW’s website.

The Government Sector Audit Act 1983 establishes the Auditor-General as an independent and statutory officer of Parliament, responsible for providing independent audit and audit-related services. The Audit Office of NSW, which is also established under the Act, is responsible for conducting audits of NSW Government entities and reporting the outcomes to Parliament.

The Grants Administration Guide provides principles-based guidance and includes mandatory requirements for ministers, officials and ministerial staff. Compliance with the Guide is a legal requirement under the GSF Act. The Guide provides an overview of the grants administration process, overarching principles that apply to all NSW Government grants, and mandatory requirements that must be complied with when administering grants.

Financial monitoring and reporting

Key points

- The GSF Act sets out the NSW Government’s financial monitoring and reporting framework.

- Agencies are required to support NSW Treasury to deliver legislated consolidated reporting through the provision of financial data, including actual spend to date, projections and forward estimates.

- The NSW Government has mandated additional financial reporting requirements which must be adhered to, including the tracking of savings and Indigenous expenditure.

- Accountable authorities and chief financial officers are responsible for the provision of timely and accurate data.

Financial monitoring and reporting for the NSW Government involves the structured and comprehensive recording of financial activities and transactions conducted by public sector agencies. This process ensures that all financial information, including income, expenditures, assets and liabilities are accurately captured and presented in accordance with accounting standards and legislation.

The primary objective of financial reporting is to provide transparency and accountability, enabling stakeholders—including citizens, policymakers, and oversight bodies—to assess the financial health and performance of government agencies and the overall financial performance of the State.

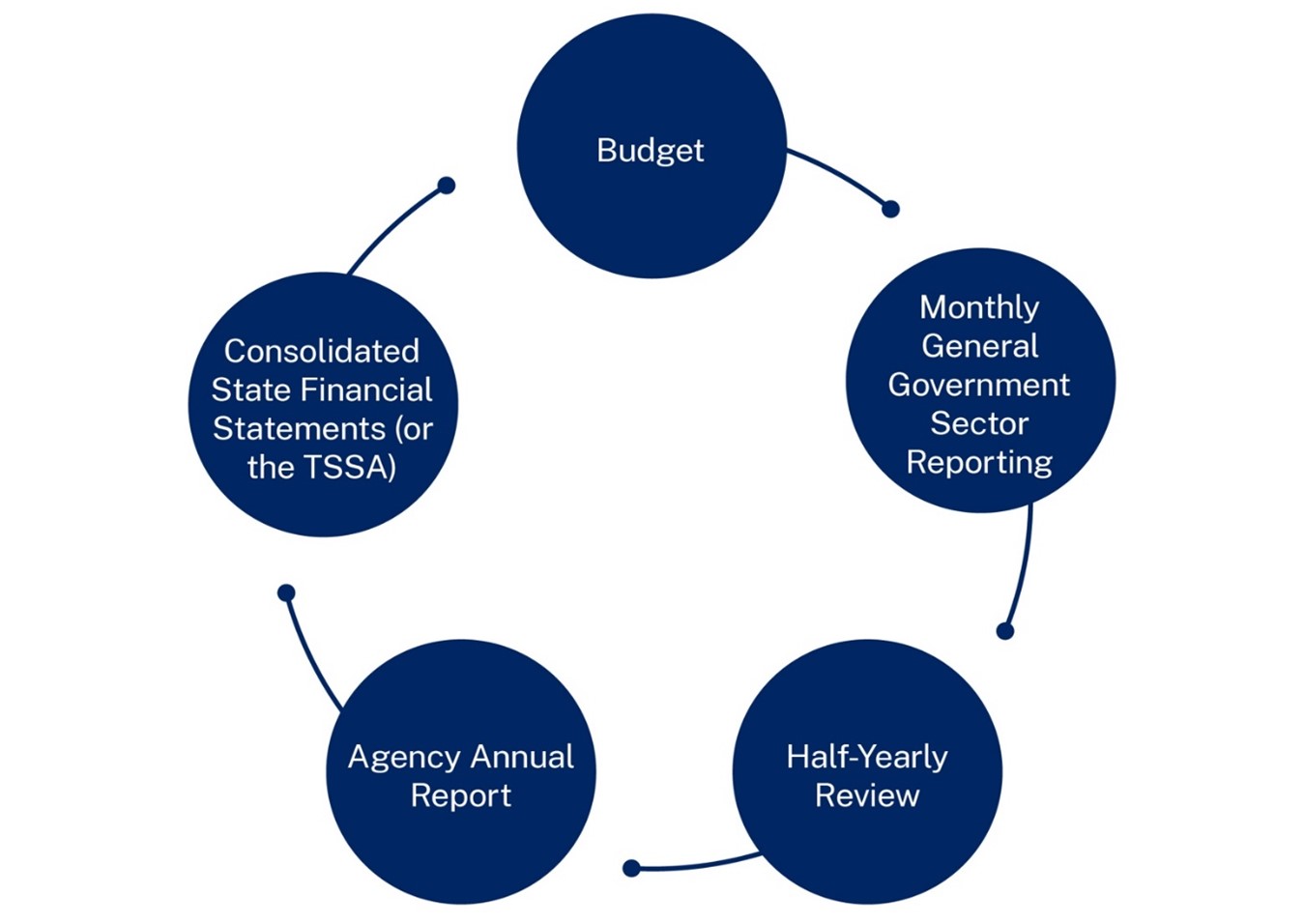

The NSW Government’s financial monitoring and reporting framework is governed by requirements set out in the GSF Act.

The requirements, as set out in Parts 4 and 7 of the GSF Act are summarised below:

- Budget – the budget papers are to be tabled in Parliament alongside the Bills for the Appropriation Act. The budget papers present budget aggregates for the general government sector (GGS) for a six-year period – the annual budget period for which the budget relates, the two years prior and the three forward years after. The papers include financial statements, details of material policy measures, a statement of risks and four-year forecasts or projections of economic variables.

- Monthly General Government Sector Reporting – the Treasurer is to publicly release a consolidated monthly statement for the GGS, which is to outline the actual operating position and cash flow of the sector.

- Half-Yearly Review – a half-yearly review must be released by 31 December each year (except in a year immediately preceding an election). The publication must contain updated projections from the original budget for the current annual reporting year, revised forward estimates and the latest economic projections. The half-yearly review also details any government decisions impacting on the budget aggregates since the Budget.

- Agency Annual Reports – reporting agencies are to prepare annual reports which include financial statements, information concerning the performance of the agency and any other information that may be prescribed by legislation or a Treasurer’s Direction. The annual report must be tabled by the responsible minister in Parliament no later than five months after the end of the annual reporting period.

- Consolidated State Financial Statements (or the Total State Sector Accounts) – after the end of each reporting period, the Treasurer is to prepare consolidated Total State Sector statements and consolidated General Government Sector statements as at the period end 30 June. The statements must be prepared in accordance with Australian Accounting Standards and are to be audited by the Auditor-General.

All general government sector agencies (GGS), public financial corporations (PFCs) and public non-financial corporations (PFNCs) are required to deliver on the legislated reporting requirements as outlined in the GSF Act, including supporting the Treasurer to deliver on consolidated sector reporting.

To enable the delivery of consolidated sector reporting, agencies are required to submit specific types of data to NSW Treasury – actuals, projections, forward estimates, planning years, and audited financial data – at specific periods. This data is to be supported by all relevant information regarding the factors that are driving any movements and variations to enable comprehensive briefings to government on the State’s financial position.

The integrity of consolidated reporting relies on the standard of the data provided by agencies. As such, it is critical that this data is accurate, reflects information held within an agency and is supported by robust internal forecasting, governance processes and systems.

The provision of financial data and statements ensure transparency and accountability regarding financial performance and position, including the way that public resources have been applied during a reporting period and how an agency has met their strategic objectives.

Further detail on each type of data is outlined in Table 5. All requirements apply to GGS agencies, PFCs, and PNFCs unless otherwise specified.

Ultimately, accountability for the quality and accuracy of data provided to NSW Treasury (via Prime) rests with the accountable authority and chief financial officer.

| Type | Frequency | Description |

|---|---|---|

| Actuals | Monthly |

|

| Projections | Quarterly and ahead of major publications, unless otherwise requested |

|

| Forward estimates1 | Ahead of major publications |

|

| End of year actual position | End of year |

|

| Annual reporting | End of the financial year |

|

1Agencies are also required to submit planning years data, which is the six years following the forward estimates. Planning years data must be reviewed by agencies at certain periods aligned to the publication of the half-yearly review and budget. Although it is not required for legislated financial reporting, planning years data supports the NSW Government’s medium-term fiscal planning.

In addition to the legislated requirements detailed above, agencies must also adhere to additional expenditure reporting requirements as requested by government. While these are not legislated, they play a critical role in supporting the government’s policy and fiscal objectives.

As such, agencies are responsible for complying with the requirements and ensuring that reporting is underpinned by accuracy and accountability of data.

The additional reporting is divided into two overarching categories:

- Targeted expenditure reporting – this includes below entity level data which may be used to support whole-of-sector reporting.

- Ministerial reporting – this encompasses reporting that provides ministerial line of sight and accountability for financial performance.

To assist agencies in meeting these required reporting requirements, NSW Treasury publishes detailed guidance throughout the year.

| Requirement | Description |

|---|---|

| Program data |

Agencies are required to maintain and report on the breakdown of financial information by programs. Agency programs are a grouping of activities, functions, tasks, or projects undertaken by an individual agency that contribute to a common outcome. Refer to Non-financial performance monitoring and reporting for further information. |

| First Nations expenditure |

Agencies are required to report to NSW Treasury on First Nations expenditure to meet the NSW Government’s requirements under the National Agreement on Closing the Gap. This reporting currently captures two categories of expenditure (1) targeted First Nations expenditure; and (2) non-targeted First Nations expenditure. Collecting both targeted and non-targeted expenditure data enables the NSW Government to continue to build a holistic evidence base of First Nations expenditure across New South Wales. |

| Cutting Waste Election Commitments and Comprehensive Expenditure Review Measures |

The NSW Government has made a commitment to reduce and maintain reduced expenditure for travel, advertising, legal, labour hire, and consultants. Agencies are required to report on these expenditure categories as part of NSW Treasury’s ongoing financial monitoring process. In addition, agencies are required to report on their progress towards the Comprehensive Expenditure Review budget improvement, reprioritisation and other savings measures. |

| Capital Expenditure Reporting |

Agencies are required to report on capital projects and programs to Infrastructure NSW (INSW) in order to record and assess implementation against time, cost, quality, risks and impediments to project delivery. These requirements are relevant to all GGS agencies, PFCs, and PNFCs. The frequency of the reporting will reflect the project tier risk-based reporting with greater analysis provided for Tier 1 – High profile/high risk projects. INSW will provide government with monthly project status reports for Tier 1 projects and quarterly reports for Tier 2 and 3 projects. INSW will also routinely provide final regular project reports and periodically report on the NSW Infrastructure Investor Assurance Framework to NSW Treasury. See the Infrastructure Investor Assurance Framework for more information. |

| Requirement | Description |

|---|---|

| Quarterly reports |

Agencies are required to provide all ministers that they are accountable to with regular financial reporting. This should happen on a minimum quarterly basis and be copied to NSW Treasury. This reporting must include performance against budget controls, transparency of where in-year underspends and overspends are occurring and risks that require mitigating actions to be taken. |

| Budget control breaches | If an agency has breached a budget control at the end of the financial year, the responsible minister is required to formally notify the Treasurer in writing. Refer to Budget controls for additional information. |

Non-financial performance monitoring and reporting

Key points

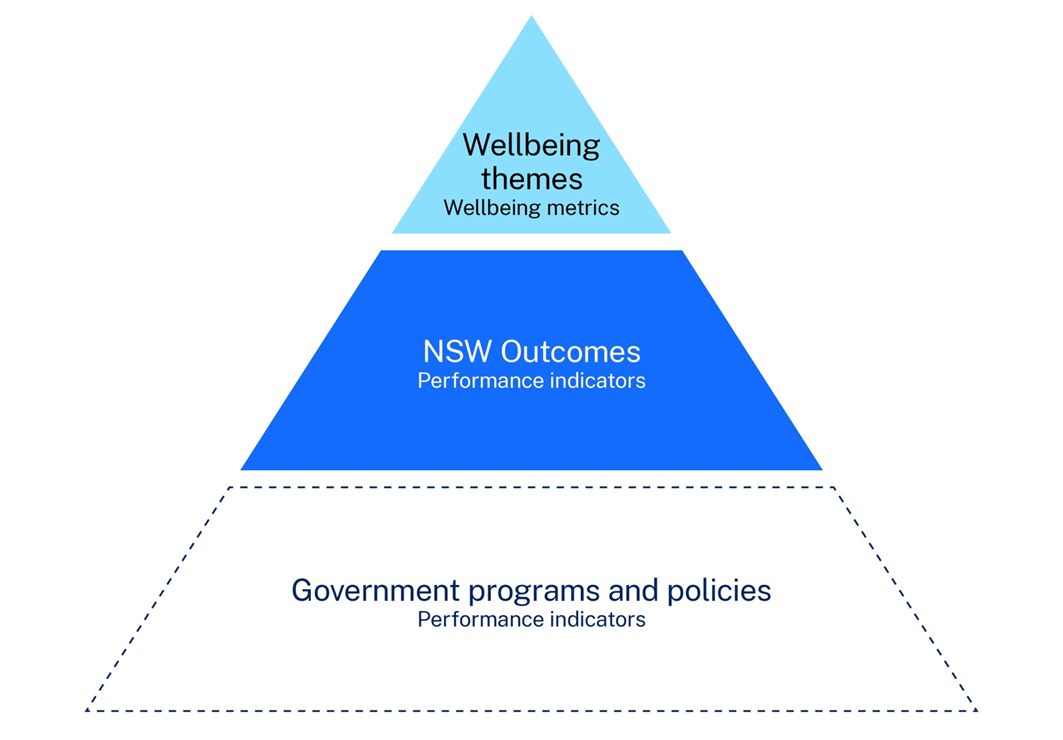

- The Performance and Wellbeing Framework supports public accountability and aligns strategic planning and performance management across government.

- The framework has three tiers (1) wellbeing themes, (2) NSW Outcomes and (3) government programs and policies. Each tier of the framework has metrics and indicators that measure progress.

- Agencies are required to collect performance information and adhere to requirements for submitting data.

The NSW Performance and Wellbeing Framework is designed to promote transparency, accountability, and evidence-based decision making. It also aims to strengthen our collective understanding of the connection between government policies and programs, and the results and impacts achieved for the people of New South Wales.

The Framework comprises three tiers:

- wellbeing themes: pillars that contribute to the wellbeing of NSW communities. There are eight themes, including Healthy, Skilled, Prosperous, Housed, Secure, Community, Connected, and Sustainable. Progress will be measured by selected wellbeing metrics. These metrics track changes in quality of life in each theme; for example, life expectancy is a metric for the Healthy theme.

- NSW Outcomes: track the State’s progress within a specific wellbeing theme by defining what the government is seeking to achieve for the community. Currently, there are 28 NSW Outcomes, measured by performance indicators.

- government programs and policies: delivery of programs and policies support achieving NSW Outcomes and wellbeing themes.

The framework aims to:

- articulate how government performance influences outcomes

- strengthen performance reporting for accountability and transparency

- improve data quality to inform government decision making, and

- support cross-agency collaboration and strategic planning to deliver improved outcomes for the State.

The framework supports a whole-of-government perspective as individual NSW Outcomes may have multiple agencies contributing to them. Cross agency networks have been established to support the collaboration needed to achieve NSW Outcomes.

Performance indicators data should be collected by agencies to track progress towards achieving NSW Outcomes. This data-driven approach ensures that program outcomes are measurable and aligned with broader governmental goals and is consistent with the GSF Act, which requires agencies to maintain performance information.

Performance against NSW Outcomes will be published in the annual Budget Papers. Additionally, performance indicators will be used to provide updates to ERC to improve accountability and support strategic planning,

As outlined in Financial monitoring and reporting, agencies are also required to break down their budgets by ‘programs’ in Prime. Agency programs in Prime are a grouping of activities, functions, tasks, or projects undertaken by an individual agency that contribute to a common outcome. All programs should be mapped to a NSW Outcome for Budget reporting purposes.

The breakdown of agency financial data supports the Performance and Wellbeing Framework by identifying the public funds allocated towards achieving certain outcomes, and provides transparency to the public regarding the use of funds.

As outlined in the Introduction, agencies must have systems in place to capture activities and corresponding financial data below the program level.

Last updated: 05/02/2025